- Proof Of Ghost

- Posts

- 👻Whales Buy $126M ETH as Markets Crash—What Do They Know?

👻Whales Buy $126M ETH as Markets Crash—What Do They Know?

Plus, Trump’s tariffs & the White House’s DeFi pivot—here’s what you need to know.

Hey, You Made It to Midweek Madness

Some people trade charts. Others trade narratives.

Right now, both are moving fast.

IN TODAY’S EDITION

→ A whale just scooped up $126M in ETH—same pattern, same timing, always buying when the market panics.

→ Trump’s tariffs just wiped out $300B from crypto overnight. Yesterday’s pump? Gone.

→ DeFi just dodged a bullet—the White House is moving to kill the IRS “Broker DeFi Rule.”

And that’s just the start. Let’s break it all down.

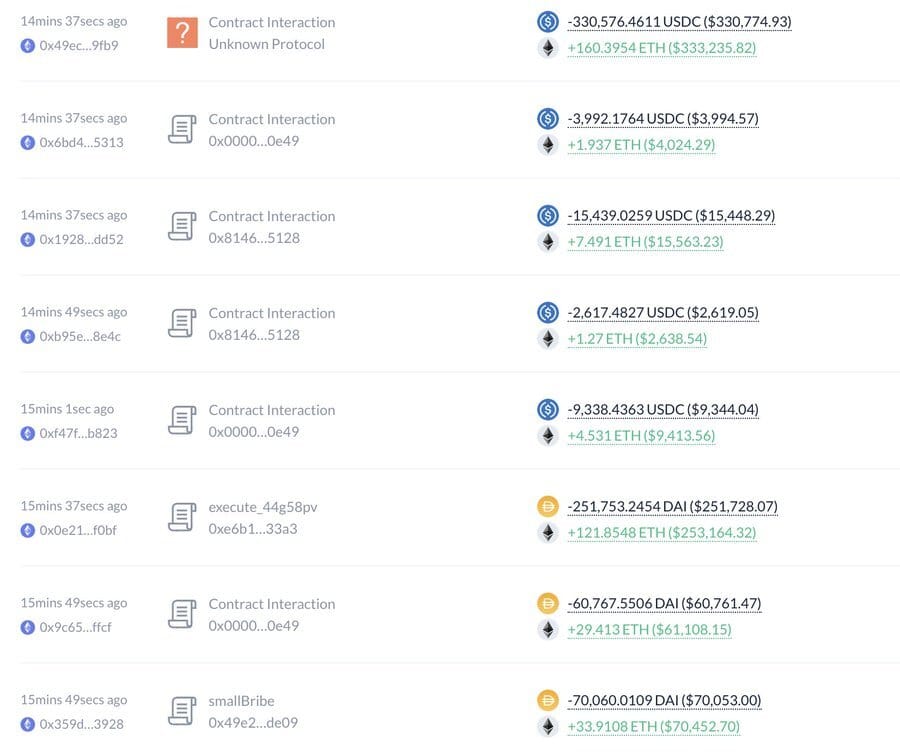

7 Siblings Just Spent $126M on ETH—Same Play, Same Pattern

If you’ve been around long enough, you know how this works.

Retail panics. Whales accumulate.

Same story, different cycle.

The entity “7 Siblings”—one of the largest Ethereum whales—just dropped another $126M on ETH.

→ Bought 4,993 ETH ($10.36M) at $2,075

→ Another wallet grabbed 5,382 ETH ($14.5M)

→ Total ETH holdings? Over 1,157,000 ETH ($2.4B)

But here’s where it gets interesting—they always buy when everyone else is selling.

Flashback to August 6, 2024:

Market crashes. Panic selling everywhere.

7 Siblings quietly buys 56,093 ETH ($129M).

February 3, 2025:

Same thing. Market dips, and they spend $111M on 45,047 ETH at $2,480.

Now, they’re back. Buying aggressively while ETH is sitting near $2,000.

So what does this mean?

→ They’re either early… or they know something we don’t.

→ Are they setting up for a run, or is this just another accumulation trap?

The game hasn’t changed. Just the players.

Trump’s Tariffs Wipe Out $300B from Crypto—What Just Happened?

Yesterday, crypto was riding high on Trump’s U.S. Crypto Strategic Reserve tease. Today? $300 billion erased in hours.

Yeah, I voted for Trump but I never thought he’d be so foolish to actually move forward with 25% tariffs given the well-documented history of how the Smoot-Hawley Tariff Act of 1930 triggered the onset of the Great Depression as global trade flows dried up.

— Gary Black (@garyblack00)

8:43 PM • Mar 3, 2025

Here’s what triggered the sell-off:

→ Trump’s new tariffs on China, Mexico, and Canada sparked a global market panic.

→ Bitcoin plunged nearly 10%, dragging the entire market with it.

→ Ethereum fell 11%, Solana 15%, and Cardano tanked 20%.

The bigger picture?

Investors were already on edge. Regulatory fears around Trump’s crypto plans weren’t helping.

Profit-taking kicked in. Markets had surged—this was an easy excuse to cash out.

Institutions are pulling back. Bitcoin ETFs saw $102.85M in net outflows, while Ethereum ETFs lost $25.35M.

One day Trump pumps the market. The next, he crashes it.

What’s next?

If these ETF outflows keep up, we could see more pain. If buyers step in, this dip might be short-lived.

The only certainty? Volatility isn’t going anywhere.

White House Moves to Kill the “Broker DeFi Rule” – A Win for Crypto?

Crypto regulation just took a sharp U-turn.

David Sacks, Trump’s crypto czar, just confirmed the White House is backing Congress’ push to scrap the IRS “Broker DeFi Rule.”

What’s the issue?

→ The rule, pushed in late 2024, redefined “brokers” to include DeFi protocols and software.

→ It would have forced DeFi users and developers to report all gross proceeds from digital asset sales—even when they weren’t directly involved in the transactions.

→ Critics called it a death sentence for DeFi innovation in the U.S.

Now?

The Trump administration is making it clear: This rule is dead on arrival.

In their official statement, they slammed the regulation as:

❌ An invasion of taxpayer privacy

❌ A major roadblock for DeFi startups

❌ A last-minute “midnight rule” from the previous administration

If this repeal passes Congress, Trump is expected to sign it into law.

Big win for crypto? Or just another political move? Let’s talk. 👇

Major Moves in Crypto This Week

→ March 5, 2:29 a.m.

Pectra is coming to Ethereum testnets 🌃

On Feb 24th, at epoch 115968, the upgrade will go live on Holesky. Then, on Mar 5, at epoch 222464, it will activate on Sepolia.

Assuming both of these go smoothly, we'll then pick an epoch for mainnet activation. More info below 👇 x.com/i/web/status/1…

— timbeiko.eth (@TimBeiko)

3:44 PM • Feb 14, 2025

Ethereum's Sepolia testnet gets the Pectra hard fork upgrade at epoch 222464. This marks a key step toward Ethereum’s next major upgrade.

→ March 5, 11:00 a.m.

Circle’s USDC Economy 2025 Webinar: Circle’s Chief Strategy Officer Dante Disparte, along with executives from Bridge, Nubank, and Cumberland, will discuss USDC’s role in the evolving digital economy.

→ March 7

President Trump will host the first White House Crypto Summit on Friday March 7. Attendees will include prominent founders, CEOs, and investors from the crypto industry. Look forward to seeing everyone there!

— David Sacks (@davidsacks47)

2:22 AM • Mar 1, 2025

Trump’s White House Crypto Summit: President Trump is hosting the first-ever White House event dedicated to crypto, bringing together top founders, CEOs, and investors. Expect major discussions on policy, regulation, and the future of digital assets in the U.S.

→ March 11

Bitcoin for America: The Bitcoin Policy Institute and Senator Cynthia Lummis will co-host this exclusive, invitation-only event in Washington. With policymakers in attendance, this could shape how Bitcoin is viewed at the federal level.

Stay tuned—this week could set the stage for major regulatory and market shifts.

TICKLE YOUR TOKENS

Me trying to predict crypto market

crypto market :

— naiive (@naiivememe)

12:09 AM • Mar 4, 2025

Alright, That’s a Wrap for Today.

Narratives are shifting by the day—whales are accumulating, institutions are selling, and the U.S. government can’t decide if it loves or hates crypto.

One thing’s for sure: this market isn’t slowing down.

Stay ahead, stay haunted—see you tomorrow.

P.S. New here and wondering what the hell is Proof of Ghost? I’m a ghostwriter—hence the wordplay. But beyond this newsletter, here’s how I can help:

→ Write LinkedIn & Twitter stories like this for you.

→ Feature your company in the newsletter with a deep dive review.

→ Record a podcast with you to talk about what you're building.

Disclaimer: Proof of Ghost is all about delivering insights, not investment advice. We break down market moves, trends, and data so you stay informed, but what you do with that info is 100% your call.

Crypto is wild, unpredictable, and sometimes downright spooky, so always DYOR (Do Your Own Research) before making any financial moves. We’re just the friendly ghost in your inbox—not your financial advisor. 👻