- Proof Of Ghost

- Posts

- 👻Trump News Leaked? Whale’s $6.8M Trade Sparks Insider Trading Debate

👻Trump News Leaked? Whale’s $6.8M Trade Sparks Insider Trading Debate

PLUS: SEC drops Kraken case, whale makes $6.8M, and Trump’s first Crypto Summit.

You Made It to Monday

Hope your weekend was solid because this week is off to a chaotic start.

Markets are swinging, whales are making suspiciously perfect trades, and the SEC is retreating faster than anyone expected.

Oh, and Trump? He’s got another big announcement lined up today.

Let’s get into it.

IN TODAY’S EDITION

→ Trump’s next move – Another investment announcement at 1:30 PM ET.

→ Whale flips $4M into $6.8M – Insider trading or pure luck?

→ SEC drops Kraken lawsuit – Six major cases dismissed in a week.

→ Crypto Summit at the White House – Trump meets top founders & VCs.

→ Market reaction – Bitcoin cools off, Trump-linked memecoins pump.

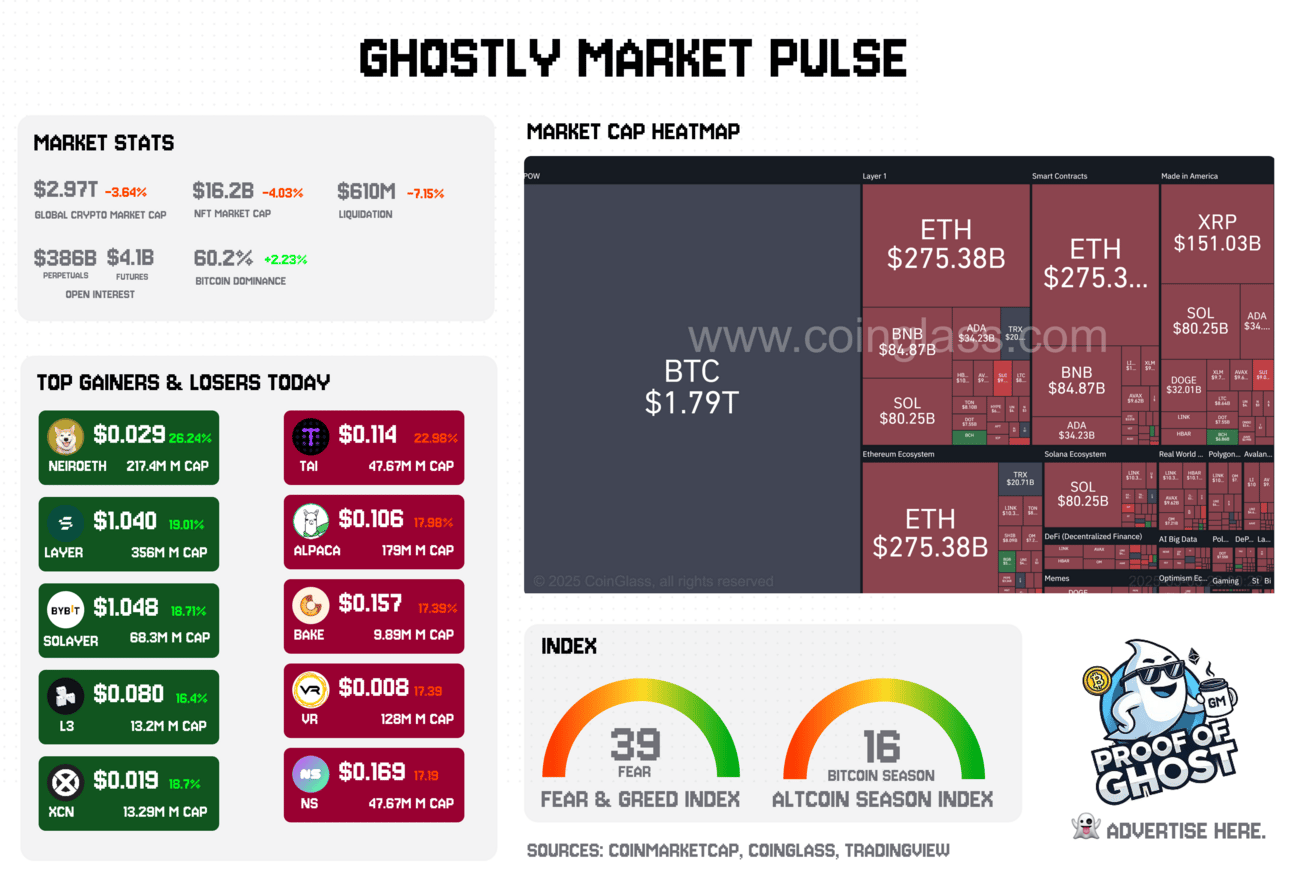

Ghostly Market Pulse – Tracking the whispers of the market - As of 12:56 pm EST

TRUMP TO MAKE ANOTHER “INVESTMENT ANNOUNCEMENT” AT 1:30 PM ET

Source: Giphy

Yesterday, Trump shook the crypto market with his U.S. Crypto Reserve announcement—sending Bitcoin past $95K and altcoins soaring.

🇺🇸TOMORROW NIGHT at 9 PM EST: President Trump delivers his first joint address to Congress. You won’t want to miss this!

— The White House (@WhiteHouse)

2:08 PM • Mar 3, 2025

Now, he’s back.

→ The White House confirms a major investment announcement today at 1:30 PM ET

→ After crypto, what’s next? Stocks? Commodities? Something bigger?

→ Markets are bracing for impact—but insiders might already know.

Yesterday’s move saw a whale make $6.8M before the news even dropped. Will we see another “perfectly timed” trade today?

What do you think Trump will announce?

Whale Goes 50x Long Before Trump’s Crypto Announcement—Insider Trading?

Source: Giphy

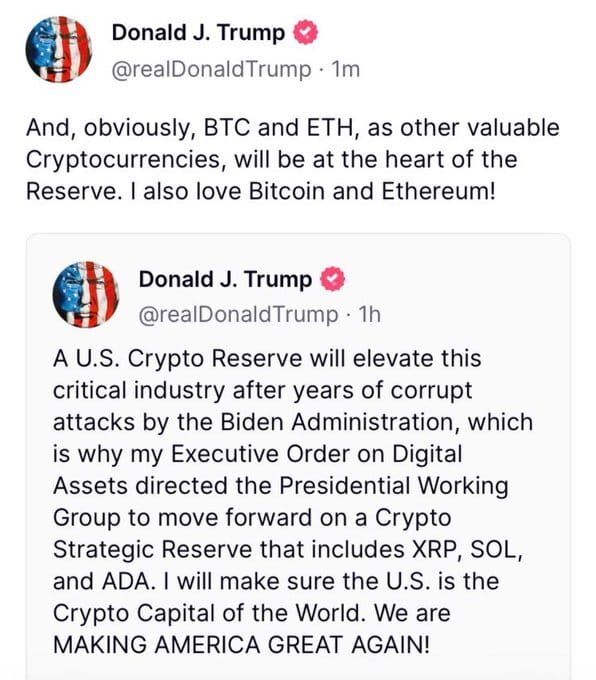

First, he announces a U.S. Crypto Reserve, shocking everyone by including XRP, SOL, and ADA in the mix.

Bitcoin maxis? Losing it.

Then, hours later, he doubles down—adding Bitcoin and Ethereum to the list. Now, everyone’s scrambling to figure out what this means.

Source: Donald Trump / Truth Social

Meanwhile, someone was ahead of the game.

Source: hypurrscan.io

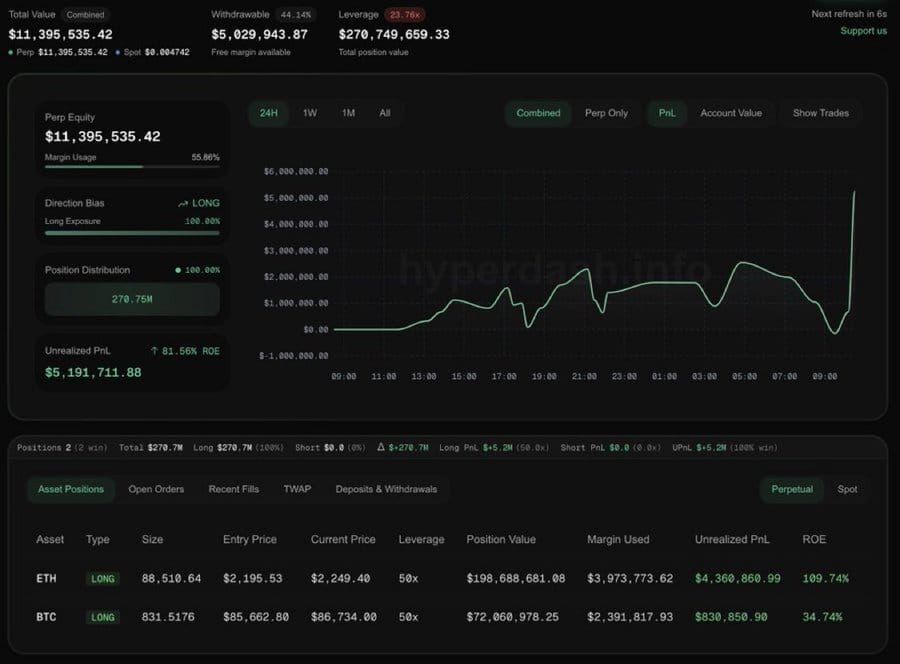

A whale went 50x long on BTC and ETH, using just $4M to create a $200M position—just before Trump’s post.

He went long at:

→ ETH at $2,197 (liquidation at $2,149)

→ BTC at $85,908 (liquidation at $84,752)

If crypto had dipped even slightly, he would’ve been wiped out.

Instead?

He closed most of his trades, walking away with $6.8M in profit.

And now?

→ Shorted BTC with 100x leverage right before today’s drop

→ Another $300K in profit

→ Has now traded 75 times on GMX in under a month

→ Win rate: 62.66%, but still down $1.22M total

This whale isn’t just lucky—either he’s the best trader alive, or he’s playing with inside information.

Market Reaction - A Wild 24 Hours

→ Bitcoin: $90,256 (-1.40% 24h)

→ Ethereum: $2,283 (-6.47% 24h)

→ XRP: $2.60 (-8.25% 24h)

→ Solana: $158.30 (-7.81% 24h)

→ Cardano: $0.97 (-9.15% 24h)

Crypto stocks also reversed early gains—Coinbase (COIN), MicroStrategy (MSTR), and Hut 8 (HUT) all dropped after initially spiking.

Some analysts are skeptical:

Arthur Hayes:

Nothing new here. Just words. Lmk when they get congressional approval to borrow money and or revalue the gold price higher. Without that they have no money to buy #bitcoin and #shitcoins.

— Arthur Hayes (@CryptoHayes)

12:56 AM • Mar 3, 2025

Lekker Capital’s Quinn Thompson:

If you're in crypto and cheering this, I don't know what to tell you. There's just no way that legitimizing two of the largest grift and scams in the existence of the industry is a good thing. Can blame it on the admin being ignorant, misinformed or bought, but this ain't it.

— Quinn Thompson (@qthomp)

6:11 PM • Mar 2, 2025

The question now: Was this just another ‘sell the news’ moment, or does this actually change everything?

SEC DROPS LAWSUIT AGAINST KRAKEN—IS THE CRACKDOWN OVER?

Source: Giphy

Back in the day, an SEC lawsuit was a death sentence for crypto firms.

(If they came after you, you fought… or settled.)

But this time? The SEC is walking away.

→ The SEC just dropped its case against Kraken, marking a major shift in crypto enforcement.

→ In the past week alone, it has dropped at least six cases, including those against Coinbase and MetaMask.

→ Gemini, OpenSea, Tron, and Robinhood also saw investigations quietly disappear.

Kraken was accused of operating as an unregistered securities exchange, much like Coinbase.

But the exchange fought back, arguing that the SEC’s rules were unclear.

Now, the SEC is retreating.

Kraken’s official statement?

We beat the SEC!

Congratulations to the best legal team in crypto.

Fighting - and beating - the SEC was not foretold. Lawyers, lobbyists and everyone in between... We had to earn it.

Details here: blog.kraken.com/news/sec-lawsu…

— Marco Santori (@msantoriESQ)

3:37 PM • Mar 3, 2025

The SEC has agreed in principle to dismiss its lawsuit against @krakenfx.

It’s a massive win for crypto, the United States of America, and the world. Since our inception, Kraken has operated with integrity and dedication to doing the right thing.

Regulation by enforcement has… x.com/i/web/status/1…

— Dave Ripley (@DavidLRipley)

3:58 PM • Mar 3, 2025

"This is more than a legal victory—it’s a turning point for crypto in the U.S."

And it’s not just Kraken celebrating.

→ Richard Heart, founder of HEX and PulseChain, just won his case against the SEC.

Federal Judge Amon dismissed the SEC's case against me, not the SEC. The SEC didn't just sue me, they sued the open source PulseX, PulseChain and HEX software as well, all dismissed. This is a win for cryptocurrency and @realDonaldTrump 's vision for America.

— Richard Heart (@RichardHeartWin)

3:53 AM • Mar 1, 2025

→ Lawmakers and industry leaders have been pushing back hard against the SEC’s tactics.

So, what happens next?

→ The only major lawsuit left is against Ripple (XRP)—but with Trump backing XRP in the US crypto reserve plan, that case might not last much longer.

→ If the SEC is backing down, are we finally getting regulatory clarity?

→ Or is this just a pause before the next wave of enforcement?

Trump to Address Industry Leaders at the First Crypto Summit

Source: Giphy

A few years ago, crypto regulation felt like a crackdown.

(Every other week, there was a new lawsuit, an investigation, or a fine.)

Now, the tide is turning—fast.

Trump to Address Industry Leaders at the First Crypto Summit

On Friday, President Donald Trump will host the federal government’s first-ever Crypto Summit at the White House.

The event, chaired by AI & Crypto Czar David Sacks, will bring together top founders, CEOs, and investors to discuss the future of digital assets under the new administration.

And it comes just days after a sweeping withdrawal of major regulatory lawsuits.

The SEC Just Pulled Back in a Big Way

In the last week alone:

→ Coinbase lawsuit dropped

→ Investigations into Gemini, OpenSea, Uniswap, and Robinhood withdrawn

→ Richard Heart’s case dismissed on jurisdictional grounds → Kraken lawsuit dropped

→ Potential resolution in Justin Sun’s case

And crypto leaders have noticed.

Cameron Winklevoss: “The War on Crypto is Ending”

Gemini’s co-founder called the SEC’s withdrawal a milestone, but also added:

"This does little to make up for the damage this agency has done to us, our industry, and America."

Translation?

The fight might not be over—but it’s shifting.

The Market’s Reaction

📈 Bitcoin is up 2.4% in the last 24 hours

📈 U.S. Bitcoin ETFs are seeing net inflows again

📈 Trump’s official memecoin (TRUMP) is up 18% from its lows

With crypto-friendly regulator Paul Atkins set to take over the SEC (pending Senate approval), and Trump making pro-crypto policy a priority, the industry could be entering a new era of regulatory support.

But does this mean crypto is in the clear?

We’ll find out Friday. 👀

Events This Week 🌍

📍 MWC25 Barcelona – March 3-4 → More info

📍 Japan FinTech Festival – March 3-7 → More info

📍 FUELD Conference USA 2025 – March 4-5 → More info

📍 SXSW – March 7-15 → More info

📍 Traders Fair Singapore – March 8 → More info

Major Moves in Crypto This Week

→ March 5, 2:29 a.m.

Pectra is coming to Ethereum testnets 🌃

On Feb 24th, at epoch 115968, the upgrade will go live on Holesky. Then, on Mar 5, at epoch 222464, it will activate on Sepolia.

Assuming both of these go smoothly, we'll then pick an epoch for mainnet activation. More info below 👇 x.com/i/web/status/1…

— timbeiko.eth (@TimBeiko)

3:44 PM • Feb 14, 2025

Ethereum's Sepolia testnet gets the Pectra hard fork upgrade at epoch 222464. This marks a key step toward Ethereum’s next major upgrade.

→ March 5, 11:00 a.m.

Circle’s USDC Economy 2025 Webinar: Circle’s Chief Strategy Officer Dante Disparte, along with executives from Bridge, Nubank, and Cumberland, will discuss USDC’s role in the evolving digital economy.

→ March 7

President Trump will host the first White House Crypto Summit on Friday March 7. Attendees will include prominent founders, CEOs, and investors from the crypto industry. Look forward to seeing everyone there!

— David Sacks (@davidsacks47)

2:22 AM • Mar 1, 2025

Trump’s White House Crypto Summit: President Trump is hosting the first-ever White House event dedicated to crypto, bringing together top founders, CEOs, and investors. Expect major discussions on policy, regulation, and the future of digital assets in the U.S.

→ March 11

Bitcoin for America: The Bitcoin Policy Institute and Senator Cynthia Lummis will co-host this exclusive, invitation-only event in Washington. With policymakers in attendance, this could shape how Bitcoin is viewed at the federal level.

Stay tuned—this week could set the stage for major regulatory and market shifts.

THE GHOST’S RECOMMENDATION

📖 Articles You Shouldn’t Miss

→ Bitcoin Sell-Off or a Perfect Retest?

BTC’s recent dip might just be a textbook breakout-and-retest play.

Read on CoinDesk

→ Trump-Linked Firm Eyes NFT & Metaverse Expansion

A firm tied to Donald Trump may be entering the NFT and metaverse space—big move or just noise?

Read on CoinDesk

→ Ethereum Foundation’s Leadership Shake-Up

Two new co-executive directors step in, with former researcher Danny Ryan now leading the new Etherealize marketing arm.

Read on The Block

→ QuickNode Rolls Out $65M Accelerator for Layer 2s

Google, Coinbase Ventures, and Dragonfly back a massive fund to scale Layer 2 projects—who will benefit?

Read on The Block

CHECK THIS OUT

TICKLE YOUR TOKENS

POV: Crypto bros who bought $ADA at 60 cents last week

— Lark Davis (@TheCryptoLark)

2:30 PM • Mar 3, 2025

the US strategic crypto reserve

— rwlk (@sherlock_hodles)

3:43 PM • Mar 3, 2025

Alright, that’s a wrap for today.

A week ago, the SEC was still fighting crypto. Today, its biggest cases are crumbling, and a pro-crypto White House Summit is about to happen.

The tides are shifting, but here’s the thing—narratives move faster than markets. If you’re just following price charts, you’re already behind.

That’s why we do this—breaking down what actually matters, every morning, no fluff, just signal.

Stay haunted, stay sharp—see you tomorrow.

Nitesh

P.S. If you liked this, share Proof of Ghost with someone who wants to stay ahead of the crypto market. We break down everything that matters—every morning no fluff, just signal.

P.S. New here and wondering what the hell is Proof of Ghost? I’m a ghostwriter—hence the wordplay. But beyond this newsletter, here’s how I can help:

→ Write LinkedIn & Twitter stories like this for you.

→ Feature your company in the newsletter with a deep dive review.

→ Record a podcast with you to talk about what you're building.

Disclaimer: Proof of Ghost is all about delivering insights, not investment advice. We break down market moves, trends, and data so you stay informed, but what you do with that info is 100% your call.

Crypto is wild, unpredictable, and sometimes downright spooky, so always DYOR (Do Your Own Research) before making any financial moves. We’re just the friendly ghost in your inbox—not your financial advisor. 👻