- Proof Of Ghost

- Posts

- 👻Prediction Market Rigged? $7M Lost, No Refunds.

👻Prediction Market Rigged? $7M Lost, No Refunds.

PLUS: Jelly trader self-liquidates, Hyperliquid responds, Chronicle raises $12M, and more bold Web3 bets.

GM. Welcome to Proof of Ghost—the newsletter that tracks crypto’s power plays, even the ones no one wants you to see.

IN TODAY’S EDITION

Today, we’re not just watching whales trade—we’re watching how they rewrite the rules.

→ $7M wiped out from a prediction market, and it looks like the system was gamed from the inside.

→ A trader tried to liquidate himself on $JELLY—and Hyperliquid just responded like a boss.

→ Chronicle just raised $12M… seven years after launching Ethereum’s first oracle.

→ And yes, the Web3 funding machine is still rolling—infra, oracles, gaming, M&A.

Let’s unpack the chaos.

Ghostly Market Pulse – Tracking the whispers of the market

A $7M prediction market manipulated. And no one’s getting their money back.

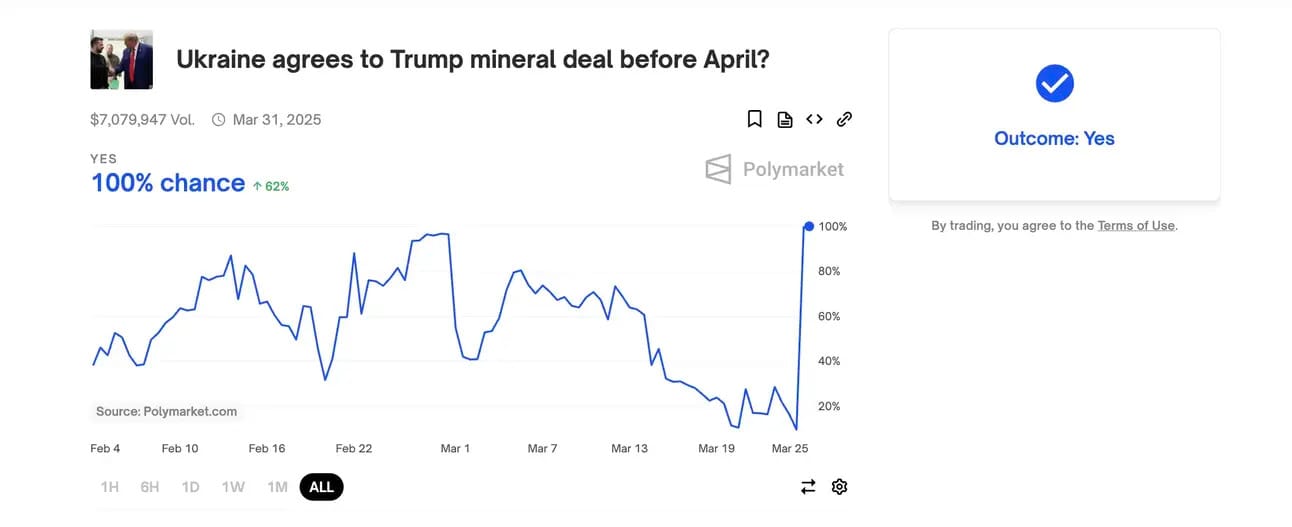

Polymarket is under fire after its biggest market ever—about a rare earth deal between Ukraine & Trump—was resolved incorrectly as “Yes,” despite no official confirmation.

Users lost millions.

Whales walked away richer.

How?

The market was resolved via UMA’s dispute system.

Just 2 whales held over 50% of voting power.

One address alone cast 5M votes—25% of the total.

The “No” resolution window mysteriously glitched closed on other markets.

Polymarket says it wasn’t a “market failure,” so no refunds.

But for users, this wasn’t just a glitch. It was engineered injustice.

And this isn’t the first time—threads are emerging showing a pattern of insiders allegedly betting, writing the rules, and coordinating resolutions.

Polymarket is revealing itself to be revealing itself a totally FRAUDULENT platform.

INSIDERS write rules, place bets, and co-ordinate with verifiers to RIG markets and SCAM their own customers for MILLIONS daily.

Last night they rigged market by @zerohedge to resolve NO,

— Folke Hermansen (@hermansen_folke)

1:48 PM • Mar 11, 2025

This raises serious questions:

– Can decentralized prediction markets stay truly fair if vote power = token size?

– Should protocols like UMA remain anonymous for dispute votes?

– What’s the line between “incentivized truth” and “rigged consensus”?

The crypto world loves trustless systems.

But if resolution systems are trust-heavy and whale-dominated—we’ve just rebuilt TradFi with a new UI.

Time for hard questions.

DeFi just witnessed one of the wildest real-time market plays in recent memory.

Source: @Lookonchain

Here’s how the $JELLY x Hyperliquid story unfolded—and why everyone’s still talking about it:

→ A trader opened a $6M short position on $JELLY (a tiny ~$20M market cap token).

→ Then he pumped the token himself on-chain—forcing a self-liquidation.

→ Hyperliquid got left holding a toxic short worth $15M+ with $10M+ in unrealized losses.

→ $JELLY’s market cap skyrocketed from $10M to $50M+ in under an hour.

→ If it had hit $150M, Hyperliquid would’ve faced full liquidation.

But Hyperliquid played it smart:

Hyperliquid liquidated 392M $JELLY($3.72M) at $0.0095, making a profit of $703K without any loss.

Then #Hyperliquid delisted $JELLY(jellyjelly).

— Lookonchain (@lookonchain)

3:46 PM • Mar 26, 2025

→ They liquidated 392M $JELLY at $0.0095, securing a clean $703K profit.

→ Then, they instantly delisted $JELLY—cutting off further manipulation.

But the drama doesn’t end here.

After evidence of suspicious market activity, the validator set convened and voted to delist JELLY perps.

All users apart from flagged addresses will be made whole from the Hyper Foundation. This will be done automatically in the coming days based on onchain data. There is no

— Hyperliquid (@HyperliquidX)

3:47 PM • Mar 26, 2025

→ Validators voted unanimously to protect the network, citing “suspicious activity.”

→ All non-flagged users will be fully reimbursed via the Hyper Foundation, with reimbursements processed based on on-chain data.

→ As of now, HLP’s realized loss stands at ~$700K USDC, with future technical improvements planned.

This is one of the most insane protocol-level responses we’ve seen in real time.

From whales gaming the system to validator-driven decisions and emergency reimbursements—this is what decentralized risk and governance actually looks like.

Real-time markets are fast. Real-time accountability needs to be faster.

Why is the first oracle on Ethereum raising a seed round seven years after launch?

Source: Chronicle

Chronicle just closed a $12M seed round backed by Brevan Howard, Robot Ventures, Gnosis, and DeFi OGs like Rune Christensen, Andre Cronje, and Stani Kulechov.

Not bad for a protocol that already secures major stablecoins like DAI and USDS.

But here’s what’s really interesting:

Chronicle isn’t playing the same game as other oracles.

No race to 10,000 protocols.

No black-box data feeds.

Instead, they’re focused on verifiability—bringing raw data and computation proofs on-chain, making oracles as transparent as the chains they run on.

And they’re quietly plugging into the backbone of onchain RWAs—providing privileged, real-time data on the reserves behind tokenized assets.

The goal?

A trustless RWA ecosystem that DeFi can actually rely on.

And that’s why they’re raising now.

RWA isn’t a trend anymore—it’s the next layer of finance.

Chronicle might just be the oracle layer powering it.

→ $20B+ already secured.

→ New cryptographic primitive (Scribe).

→ Integrations with Centrifuge, Midas, Euler, Morpho, M^0, and more.

Watch this space. RWA might outscale DeFi faster than we expect.

Web3 Funding Recap | March 25

Another day, another round of bold bets in crypto, gaming, and infra. Here’s what went down:

→ Spot Zero raised $4.5M in pre-seed led by Bitkraft Ventures

→ Chronicle, Ethereum’s first oracle, bagged $12M in seed funding from Strobe (ex-BlockTower) and OG angels like Rune Christensen & Andre Cronje

→ Coresky secured $15M Series A led by Tido Capital—infra plays still holding strong

→ Immortal Rising 2, a gaming title, locked in $3M from The Spartan Group

→ Game Informer was acquired by Gunzilla Games—traditional media + web3 gaming incoming

→ OpenBlocks and Cantina Royale also saw M&A action, with SupraOracles and Boomland as buyers

Gaming, infra, and oracle layers are still hot zones—and we’re not even halfway through the week.

Which of these moves do you think will make the biggest impact in Q2?

Tickle Your Tokens

95% of campaigns:

— Esty (@sai_no_hanaya)

3:45 PM • Mar 26, 2025

After 5 years of holding, i finally can afford a lambo. Thank Ethereum

#Crypto#Bitcoin #Ethereum#Blockchain

— Techtoken (@Techtoken_in)

3:37 AM • Mar 26, 2025

Every altcoin holder right now after regaining 1% of their portfolio

— The Crypto Professor (@TheCryptoProfes)

6:33 PM • Mar 24, 2025

Alright, that’s it for today.

When prediction markets get rigged, self-liquidations go viral, and oracles raise rounds like it’s 2018—you realize this space isn’t just volatile.

It’s experimental finance playing out in real time.

And we’re here to track it—so you don’t get caught holding the bag.

Stay haunted, stay sharp—see you tomorrow.

P.S. If you liked this, share Proof of Ghost with someone who wants to stay ahead of the crypto market. We break down everything that matters—every morning, no fluff, just signal.

Quick heads-up—Proof of Ghost is all about delivering insights, not investment advice. We break down market moves, trends, and data so you stay informed, but what you do with that info is 100% your call.

Crypto is wild, unpredictable, and sometimes downright spooky, so always DYOR (Do Your Own Research) before making any financial moves. We’re just the friendly ghost in your inbox—not your financial advisor. 👻