- Proof Of Ghost

- Posts

- 👻Another Perfect Whale Trade—Luck or Insider Info?

👻Another Perfect Whale Trade—Luck or Insider Info?

PLUS: Stablecoin regulations tighten, Trump’s crypto stance questioned, and X hit by major cyberattacks.

The crypto space never sleeps, and neither do the headlines.

Today, we’re diving into stablecoins getting reshaped by global regulation, another whale with impeccable timing, Trump’s crypto stance (or lack thereof), and X facing a third major outage.

Let’s get into it.

IN TODAY’S EDITION

Stablecoin Shake-Up – Global regulations are redefining the market. Game-changer or power grab?

Another Perfect Whale Trade – $2.15M in 50 minutes. Just lucky, or something else?

Trump’s Crypto Stance – Big promises, no real action. What’s next?

X Goes Down Again – Hackers claim responsibility. What does it mean for centralized platforms?

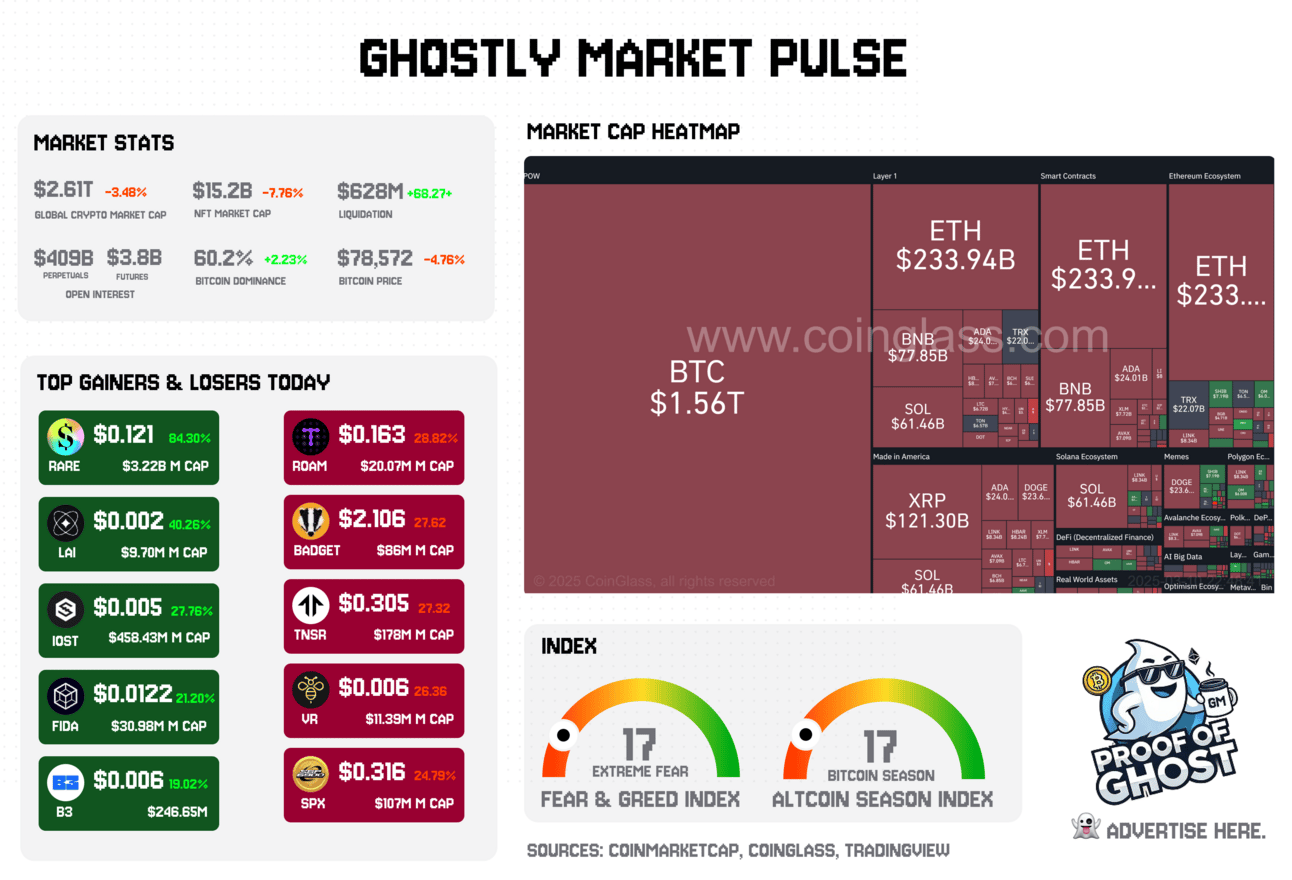

Ghostly Market Pulse – Tracking the whispers of the market

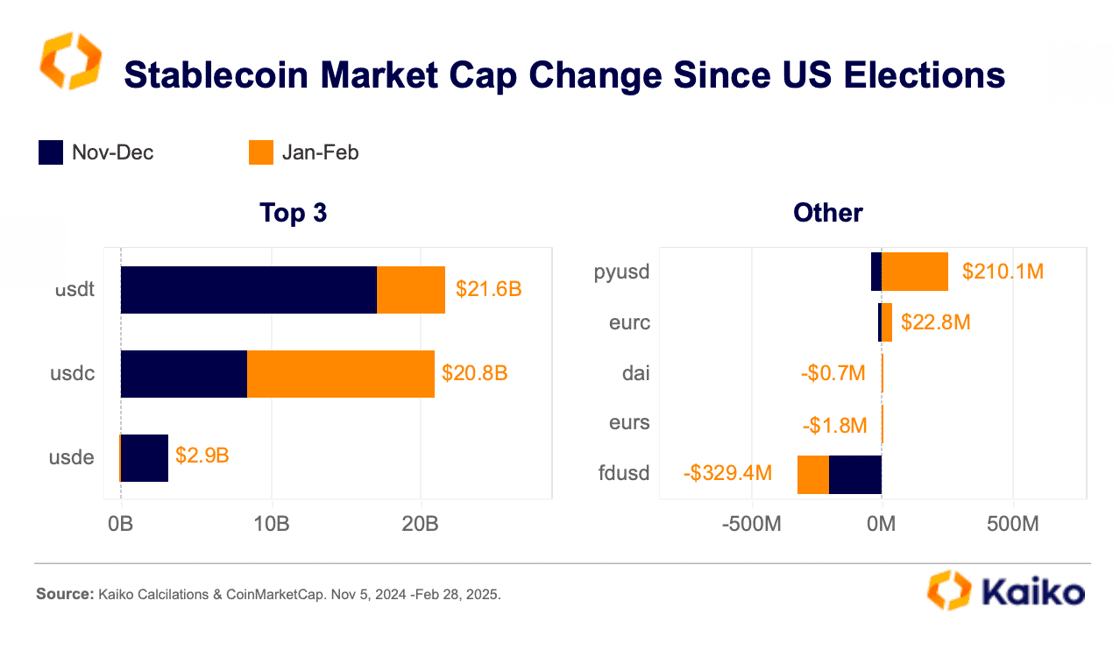

The Stablecoin Market Is Being Rewritten—Here’s Why It Matters

Stablecoins have been crypto’s quiet powerhouse—fueling over 80% of global trading volume and acting as the bridge between crypto and traditional finance.

But things are changing fast.

→ Europe’s MiCA regulations are tightening oversight, reshaping the EUR stablecoin market.

→ The U.S. Senate is set to vote on the Genius Act, which could regulate stablecoins like traditional financial institutions—potentially opening the door for more institutional adoption.

→ South Korea is moving to regulate stablecoin-to-fiat cross-border transactions, as demand for USDT surges.

This isn’t just about compliance—it’s about who controls the future of money.

For years, Tether (USDT) dominated the market.

But in the past few months, its market share has dropped from 84% to 77%—while regulated stablecoins like USDC, PYUSD, and EURC are quietly gaining ground.

Regulation isn’t killing stablecoins—it’s reshaping them.

At the same time, geopolitics is playing a role.

→ In Korea, stablecoin demand spiked after the December Martial Law crisis.

→ In Brazil, traders are cashing out stablecoins amid fears of a government ban on self-custodial wallets.

→ In Turkey, where inflation remains high, USDT demand is stronger than ever.

The bigger picture?

Stablecoins are no longer just a crypto tool.

They’re becoming an essential part of global finance, and governments know it.

The question is: Will regulation make them stronger or just hand over control to traditional finance?

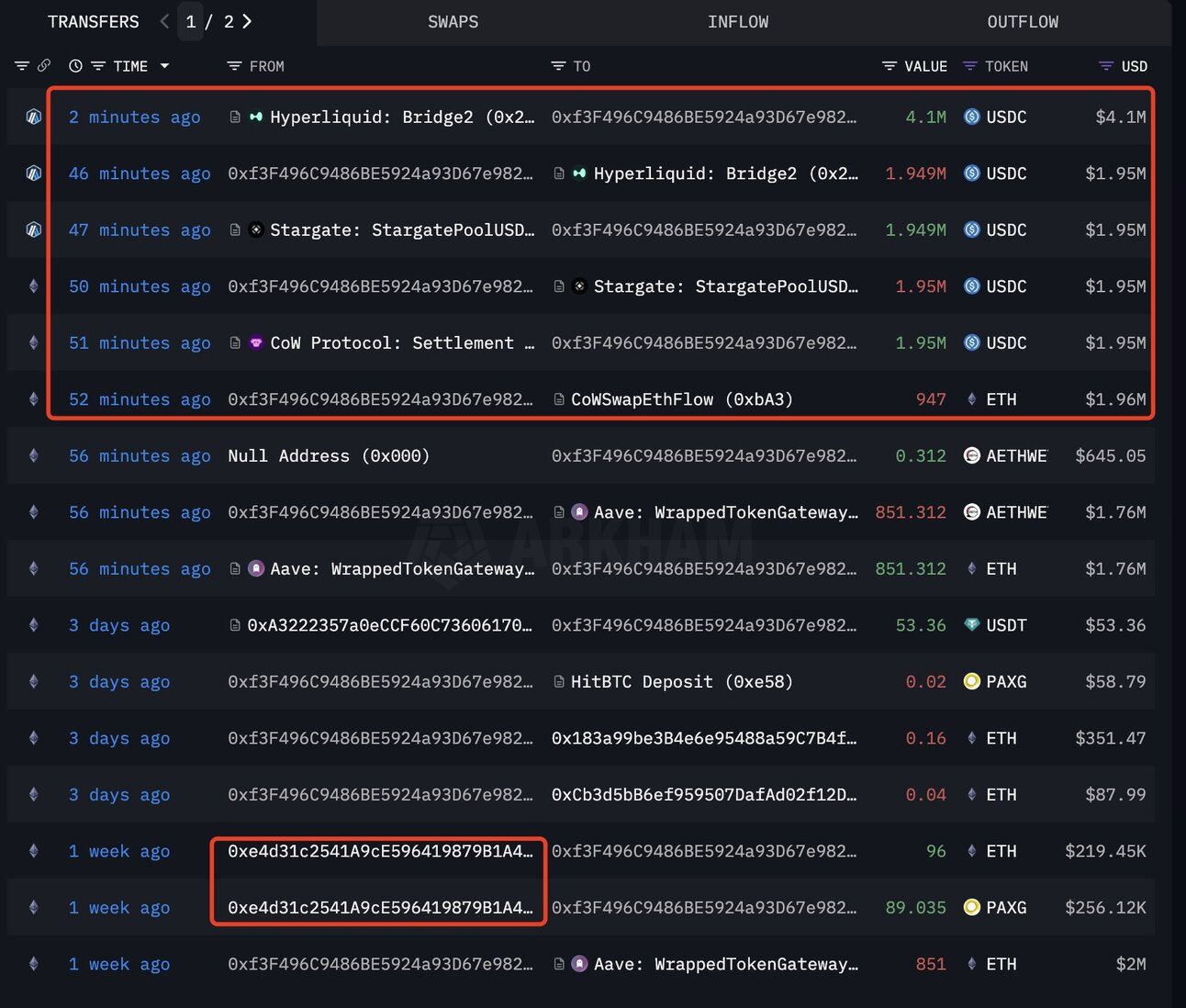

Another Day, Another Perfect Trade—Luck or Insider Play?

Source: @Lookonchain

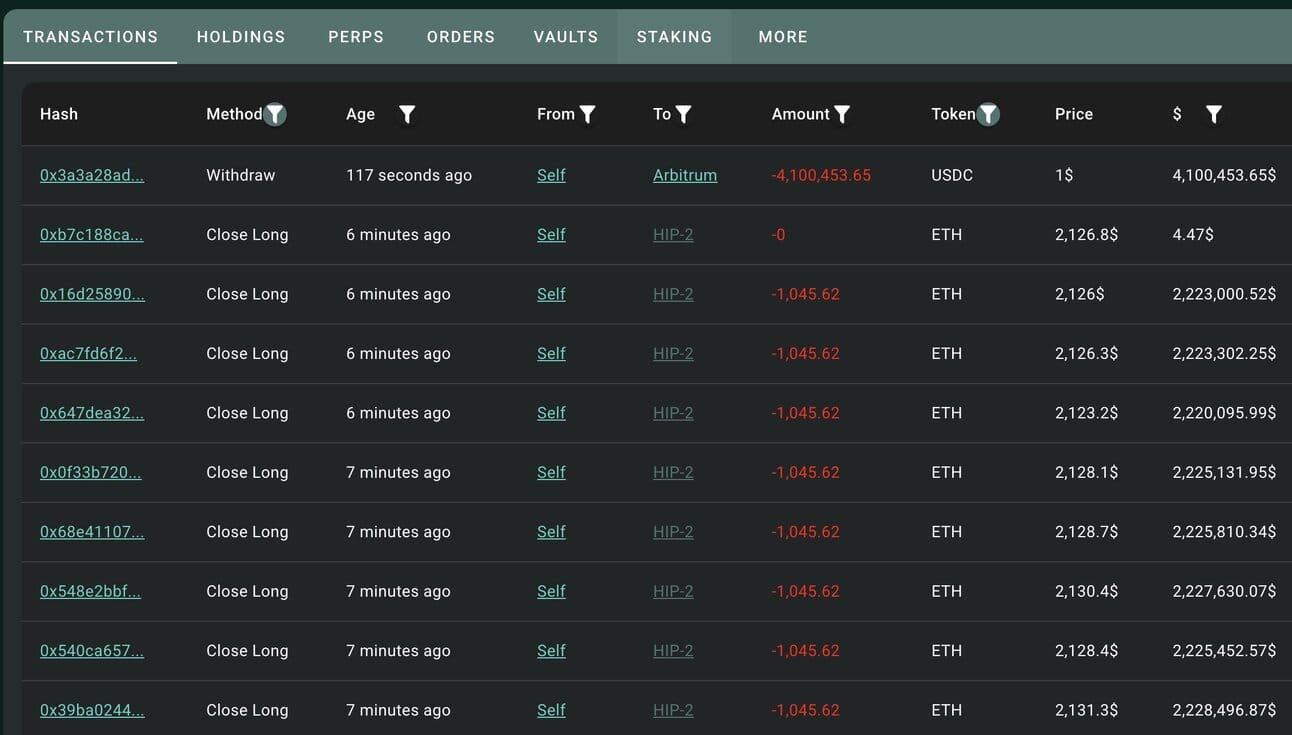

A whale just pulled off another insanely precise trade, making $2.15M in just 50 minutes.

Here’s how it went down:

→ Sold 947 ETH for $1.95M USDC

→ Deposited into Hyperliquid

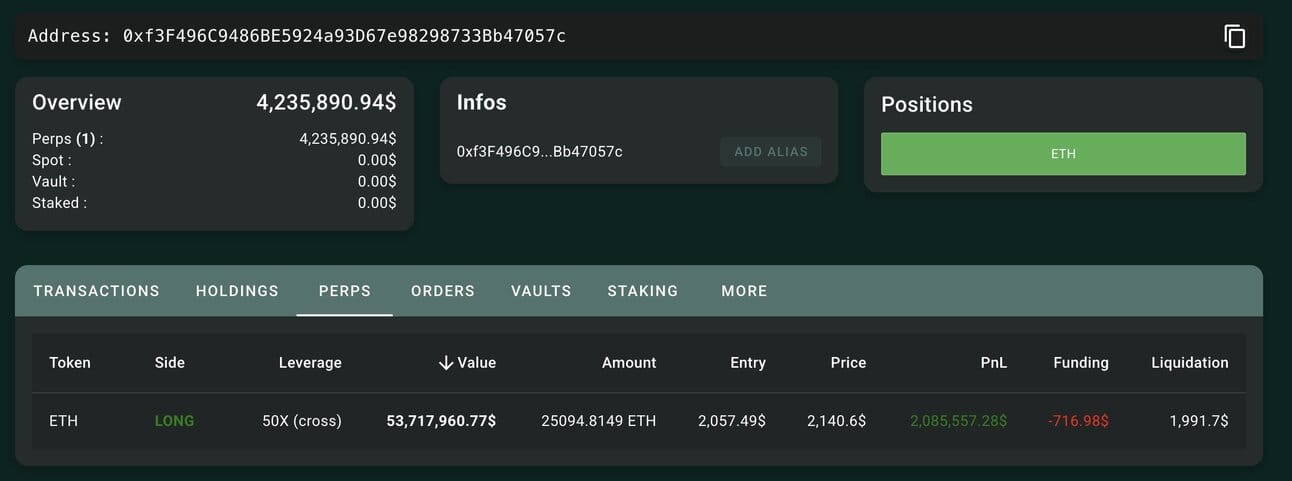

→ Went 50x long on ETH—building a $53.7M position

Source: @Lookonchain

→ Liquidation was at $2,008—meaning if ETH had dipped even slightly, they’d be wiped out

Source: @Lookonchain

→ ETH surged → They closed the trade → Walked away with $2.15M profit

Now, here’s the thing…

This isn’t their first perfectly timed move.

This is the same whale who made $6.8M last time by placing a massive 50x leveraged bet on BTC and ETH—right before Trump’s executive order dropped.

Once? Maybe lucky.

Twice? Feels like more than just skill.

Either this person has a sixth sense for market timing, or they know exactly when big announcements are coming.

And that raises the real question:

Is high risk really high risk when you already know the outcome?

Trump’s Crypto Stance: All Hat, No Cattle?

Source: Giphy

The U.S. isn’t buying your bags—but at least it’s not buying someone else’s either.

Trump’s Crypto Summit was hyped as a turning point. Instead, it delivered… well, not much.

→ No real commitments.

→ No direct Bitcoin purchases.

→ No regulatory clarity beyond vague promises.

Just a lot of people taking turns "kissing the ring", as Avi Feldman and Jonah Van Bourg put it.

The market saw right through it—prices dumped immediately.

Crypto Is Still a Political Toy

If Trump is serious about crypto, it needs real legislative action. Otherwise, this is just another short-term political play.

Right now, crypto is stuck in partisan limbo.

→ Republicans are embracing it as a political weapon against "Biden’s overreach."

→ Democrats? Still stuck in the Elizabeth Warren narrative—Bitcoin is "for criminals," and stablecoins are "shadow banking."

The real danger? If this remains a Republican-only issue, everything Trump does can be reversed at the stroke of a pen if Democrats regain control.

What Needs to Happen?

The 119th Congress has 18 months to pass real legislation. That’s the window.

Crypto has the same 18 months to prove it’s more than just speculation and offshore casinos.

Otherwise, we’re back to square one in 2026.

The Silver Lining?

→ Stablecoins got a serious endorsement. The U.S. finally sees them as a weapon to strengthen the dollar.

→ Texas is moving faster than the Feds. Senate Bill 21 now allows Texas to hold Bitcoin as a reserve asset. Will other states follow?

But then there’s Trump, undercutting his own stance on Bitcoin just days later:

"Never sell your Bitcoin? I don’t know if they’re right or not—who the hell knows?"

So… do we celebrate the momentum or call it what it is?

A short-term political stunt? A real shift? Or just another chapter in crypto’s endless regulatory rollercoaster?

X Goes Down for the Third Time Today—And It’s Not Just a Glitch

Something bigger is happening.

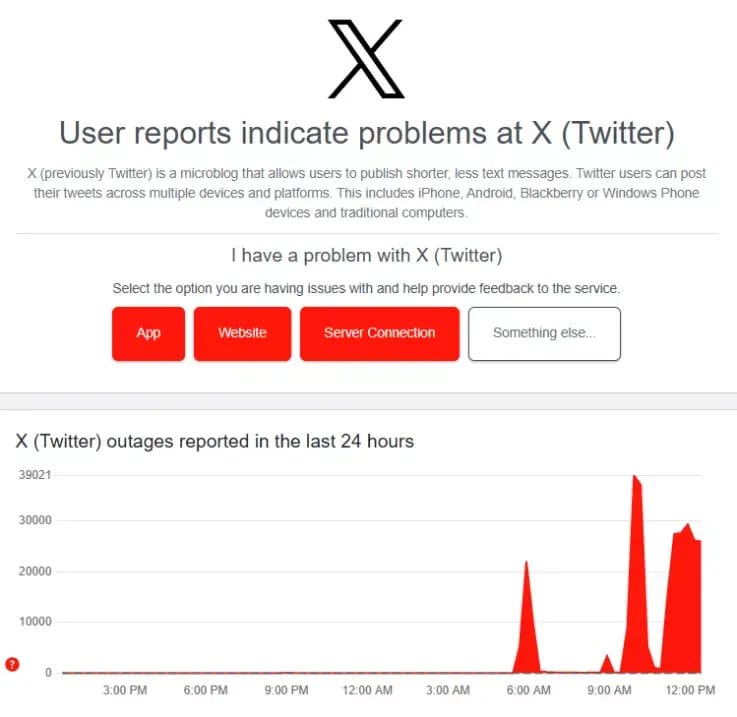

For the third time today, X (formerly Twitter) is experiencing major outages, with users unable to log in or load the platform.

There was (still is) a massive cyberattack against 𝕏.

We get attacked every day, but this was done with a lot of resources. Either a large, coordinated group and/or a country is involved.

Tracing …

— Elon Musk (@elonmusk)

5:25 PM • Mar 10, 2025

And now, the hacking group Dark Storm Team has claimed responsibility, saying this is a coordinated DDoS attack.

→ 40,000+ outage reports flooded Downdetector

→ X’s rival BlueSky is seeing a surge in Google searches

→ Dark Storm Team has a track record of targeting high-security systems

DDoS attacks aren’t just about taking a platform offline. They’re about disrupting information flow, causing chaos, and testing vulnerabilities.

If this is truly an attack, it raises serious questions:

→ Who else is a target? If X is under attack, what about other social platforms?

→ Why now? Dark Storm Team has previously targeted NATO and government sites—why focus on X?

→ How vulnerable are centralized platforms? If a single attack can take X down, how fragile is the infrastructure?

Meanwhile, BlueSky—Twitter’s biggest competitor—is seeing a massive spike in interest. People are already looking for an alternative.

One thing is clear: whatever’s happening to X right now is bigger than just downtime.

Tickle Your Tokens

BITCOINERS THIS WEEK

— The ₿itcoin Therapist (@TheBTCTherapist)

12:20 AM • Mar 10, 2025

Mom : your etherim is 1900, time to get a job " Mr investor "

— naiive (@naiivememe)

3:46 AM • Mar 10, 2025

POV: Crypto investors who bought Bitcoin at $107K

— Lark Davis (@TheCryptoLark)

1:30 PM • Mar 10, 2025

Seeing #Bitcoin under $80k but not having any cash left to buy the dip:

— Simply Bitcoin (@SimplyBitcoinTV)

5:29 PM • Mar 10, 2025

Regulation is tightening. Political narratives are shifting. And somehow, a single whale keeps pulling off perfect trades.

The crypto market is more unpredictable than ever—but one thing is clear: the next few months will define the future of stablecoins, government involvement, and market resilience.

Until then, keep watching, keep questioning, and most importantly—keep stacking insights.

Stay haunted, stay sharp—see you tomorrow.

P.S. If you liked this, share Proof of Ghost with someone who wants to stay ahead of the crypto market. We break down everything that matters—every morning at 8 AM (UST), no fluff, just signal.

Quick heads-up—Proof of Ghost is all about delivering insights, not investment advice. We break down market moves, trends, and data so you stay informed, but what you do with that info is 100% your call.

Crypto is wild, unpredictable, and sometimes downright spooky, so always DYOR (Do Your Own Research) before making any financial moves. We’re just the friendly ghost in your inbox—not your financial advisor. 👻